What do junk bonds yield today? The table below lists the yield of the Merrill Lynch junk bond index (High-Yield index), as well as the latest SEC yield on some of the top junk bond (high-yield) dedicated funds.

A note of caution when you are looking at yields on junk bond funds; Like all SEC yields, these yields are based on the last 30-days of income generated by the fund. They are not directly comparable to the yields on the Merrill Lynch junk bond indices.

| Junk Bond Description | Symbol | Yield 5.31.22 | 9.30.22 |

| Merrill Lynch U.S. High-Yield Index | n.a. | na | 9.58% |

| Vanguard High-Yield Corporate | VWEHX | 5.69% | 7.04% |

| Fidelity High Income | SPHIX | na | 8.01% |

| T. Rowe Price High-Yield | PRHYX | na | 8.26% |

| American High-Income Trust | AHITX | na | 7.20% |

| Pimco High Yield | PHDAX | na | 7.15% |

| BlackRock High Yield | BHYAX | na | 7.29% |

| iShares iBoxx $ HY Corporate Bond ETF | HYG | 6.57% | 8.18% |

| SPDR Bloomberg Barclay’s HY Bond ETF | JNK | 6.97% | 6.97% |

How do Junk Bond Yields Today Compare to History?

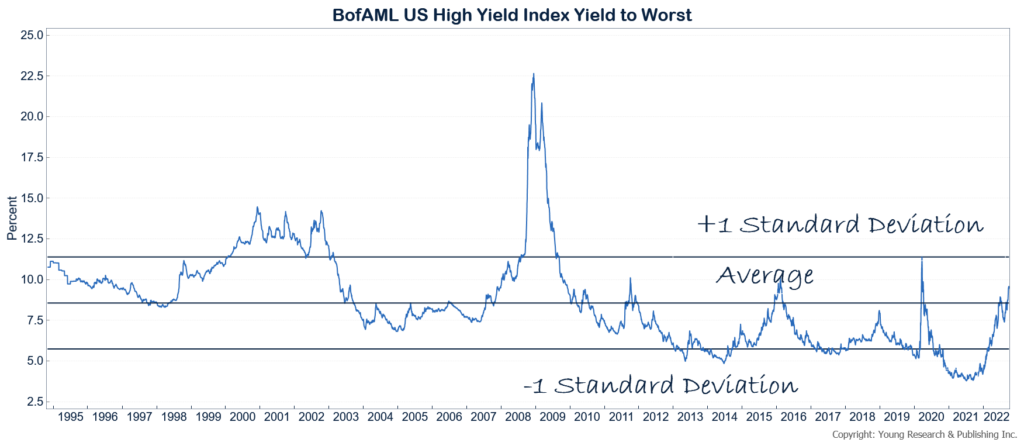

The chart below shows the historical yield of the Merrill Lynch U.S. high-yield (junk bond) index along with average and plus and minus one standard deviation lines. Today, junk bond yields are at some of the lowest levels in the last 25 years.

If you are considering junk bonds because yields are so low on government and investment-grade corporate bonds read this first.

Be sure to also check out our GNMA bond yields post to find out what mortgage-backed securities guaranteed by the U.S. government yield.