Are you tired of the media’s nonstop market analysis yet? It’s distracting at best and harmful to your health at worst. With the Dow up 7.1% in the month of July, it’s worth noting how little ground has been picked up from mid-June of this year through the end of July. Even after climbing out of the valley of the March 2009 lows, the price of the Dow is still only worth three-quarters of its value from its October 2007 peak.

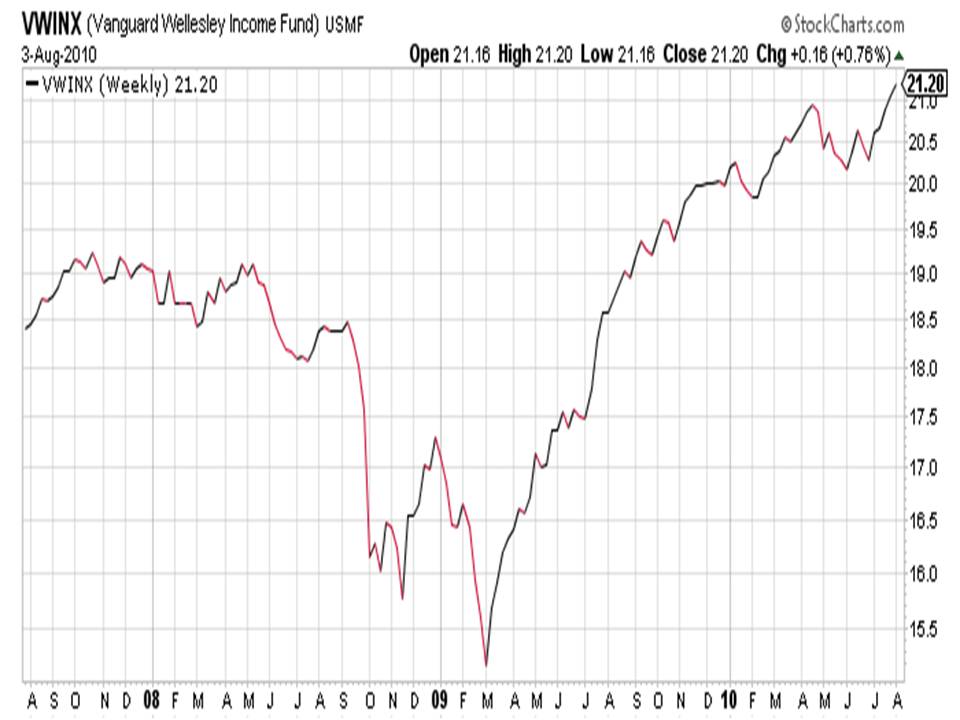

Those taking a balanced investment approach had a much better experience. I like using the Vanguard Wellesley fund to illustrate the advantages of a balanced investment strategy, especially when talking to those in retirement. This example, like the one above, shows the fund climbing out of the valley of the March 2009 lows—but what’s different is that it’s worth quite a bit more than it was three years ago. As you can see, investors in this fund over the last three years have had a relatively smooth ride compared to the Dow, and even more importantly, they have been made whole and then some.

Smoothing out the ride should be every retired investor’s goal and there are a number of ways to do this. For example, the Vanguard Wellesley fund doesn’t have any gold in it. A little bit of gold would have certainly improved the three year performance. Below is a chart of the SPDR gold ETF, GLD.