The melt-up in U.S. stock prices in February has been nothing short of spectacular. Of the 14 trading days this month, stocks have increased on twelve. The average increase in the S&P 500 on up-days in February has been 0.33%.

A third of a percent may not sound like a big number, but if you compound that out over just 60 trading days, you are looking at a return of more than 20%.

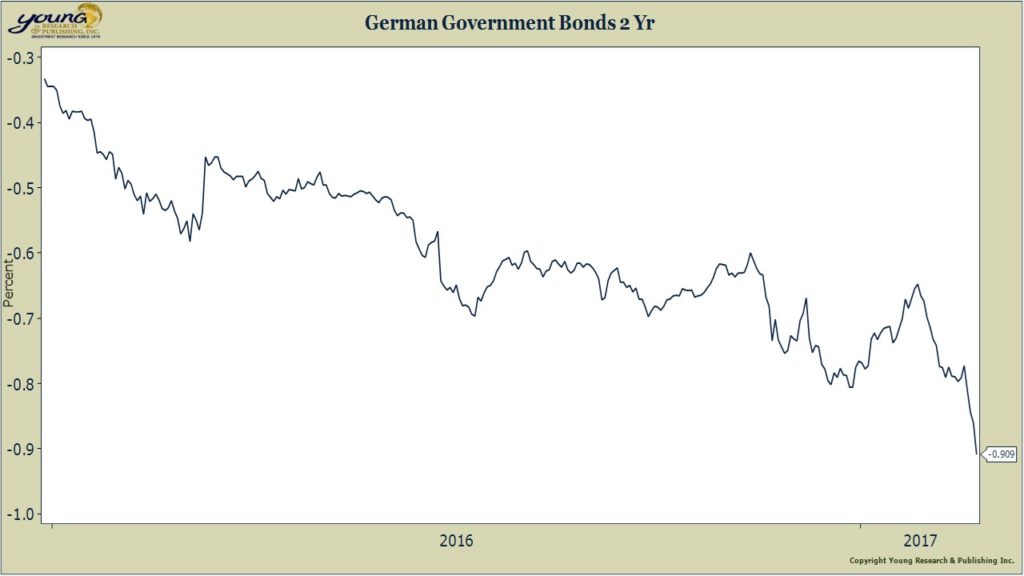

For novice investors, the relentless rise in stock prices may have led some to believe there is little risk in the market today. That would of course, be a mistake. Because while U.S. shares show few signs of stress, German government bonds have plumbed fresh lows.

The yield on two-year German government bonds is now negative 0.91%. Investors are paying dearly for the privilege of lending money to the German government.

What do German investors see that U.S. stock market investors are ignoring?

In short…risk. Populist victories in the U.K., U.S., and rising poll numbers for the populist/nationalist candidate in France, have German investors worried about a breakup of the euro.

The rising probability of a euro breakup is not a risk you want to ignore. Continue to invest with prudence and perspective.