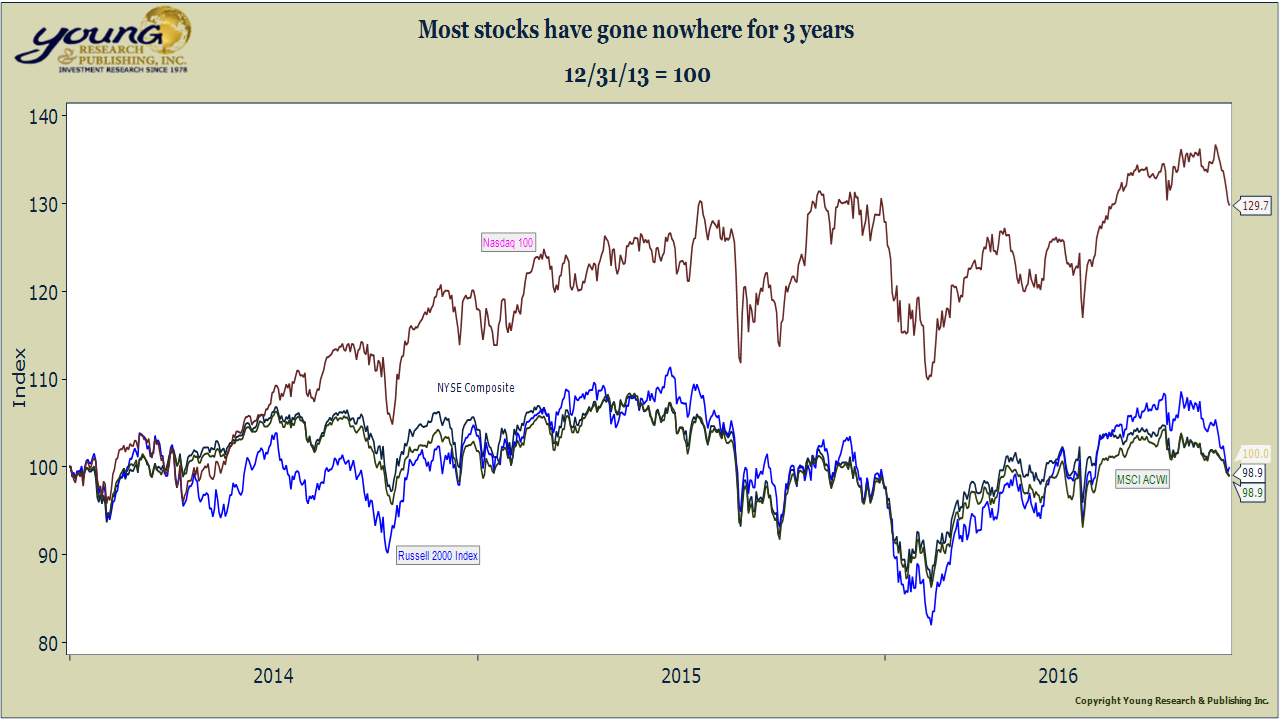

Notwithstanding this morning’s big rally, since year-end 2013 most stocks have gone nowhere. The NYSE Composite, the Russell 2000, and the MSCI All-Country World Index are all basically flat over the last 34 months. The one index on our chart below that is up during this time-period is the NASDAQ 100. Carried by the likes of Apple, Amazon, Facebook, Google, and Microsoft, the Nasdaq 100 is up about 30% since year-end 2013.

If you aren’t willing to speculate with your serious money and risk another dotcom era bust in NASDAQ stocks, what’s the best way to invest in a flat market? At Young Research we have long advised a dividend focused investment strategy.

A steady (and rising) stream of cold hard cash in the form of dividend payments can help compensate for weak stock market performance and put investors in or nearing retirement at ease during periods of heightened stock market volatility.

If you are not yet pursuing a dividend-focused investment strategy, now is the time to get started.